Driving a sports car has certain distinctive advantages, but it can also result in expensive insurance expenses. Because these cars are more likely to be involved in crashes and have higher repair expenses, Best Insurance For Sports Cars rates tends to be higher.

Best Insurance For Sports Cars is more expensive than that for regular cars, however, some companies have more reasonable coverage alternatives than others. It’s important to compare quotes from many providers in order to discover the best deal for you because individual factors like your location, credit score, or the way you store your car can also have an impact on prices.

What is sport car insurance?

A sports car insurance policy is a contract for auto insurance between you and a sports car insurance provider that guards against financial loss in the event of an accident. It was created specifically with a sports car in mind.

Keep in mind that you should also evaluate “what constitutes a sports car for insurance purposes.” Even while you may think a certain car is “sporty,” it may not always be the case. Although there are “safe sports vehicles,” safety varies. Also, you might be surprised by the sporty car with the least insurance.

Some reputable insurers may even refuse to offer coverage for particular brands, models, or vehicles with a specified value when it comes to high-priced or high-horsepower sports cars. Specialized insurance for high performance cars may be required if you insure a high-value or historic sports automobile.

The 4 Best Insurance For Sports Cars You Can Refer

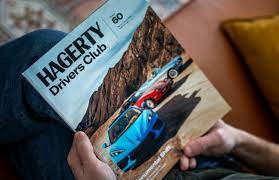

1. Hagerty sports car insurance companies

Hagerty needs to be on your list of companies to contact for a quote if you own a vintage or collectible sports car. With Hagerty’s Guaranteed Value coverage, you can rest easy knowing that your automobile is fully protected against depreciation-related surprises.

Hagerty has a staff in place to assist in finding difficult-to-find parts, which can be a challenge when sourcing parts for vintage and antique sports cars. With Hagerty, you won’t be able to combine your house and Best Insurance For Sports Cars policies, but you will be eligible for a discount if you cover more than one vehicle.

Online or over the phone, manage your account. You can also get assistance from a large network of independent agents to secure coverage or manage policy issues.

2. Chubb Company

Chubb is a well-known independent insurer that offers agreed-value coverage. The insurance for high performance cars makes a check for the agreed value in the event that your automobile is totaled or stolen, with no reduction for depreciation.

To assist retain value and dependability, Chubb will pay the cost of replacement parts if you need repairs. Additionally, you’ll discover the greatest level of rental car reimbursement coverage available on the market, ensuring that you may resume your travels in comfort even if an accident temporarily derails them. Additionally, Chubb’s liability limits are substantially larger than those offered by the majority of other insurers.

3. State Farm

State Farm, the Best Insurance For Sports Cars in the country, combines a solid financial foundation with small-town attentiveness. State Farm is a well-liked option because it offers sizable discounts for having several vehicles and insurance plans. Manage your policy through an online portal, a smartphone app, or a skilled representative in person. For good drivers with mid-range sports cars, State Farm is a reliable option.

4. Allstate

Similar to State Farm, Allstate has a national network of captive agents, which means they are knowledgeable about certain policies and have a focus on insurance for a single firm.

While Allstate doesn’t cover brand-new exotics, it is a good option for the majority of other sports car owners.

You can consolidate your coverage and save money by taking advantage of discounts for numerous vehicles and insurance plans. Manage your policy by visiting one of Allstate’s hundreds of agents, managing it online, or using a mobile app.

How do insurers decide sports car insurance rates?

Due to the fact that a sports car is frequently used as a second or recreational vehicle, how you use it and how frequently you drive it will greatly affect your rate. Generally speaking, the easier it is to speed, which can result in more accidents and higher sports car insurance rates, the more horsepower a car boasts.

But let’s say you just use your sports vehicle on the weekends and you only log 5,000 or fewer kilometers annually. In general, you’ll pay less for insurance than someone who commutes to and from work in a sports vehicle. Even if you infrequently drive your sports car and have a spotless driving record, you can still pay significantly more for auto insurance due to the performance car insurance cover.

Sports cars are viewed as a higher risk by sports car insurance companies due to their high pricing, specialized parts, and powerful engines. Best Insurance For Sports Cars could cost more because:

- The risk of theft may be higher for sports automobiles. Envy-worthy and may be more likely to be stolen are sports and exotic cars, especially convertibles because they’re simpler to get into.

- Their components are more challenging to replace. Because premium and sports car components aren’t frequently mass-produced, problems are more challenging and expensive to fix.

- A larger risk of damage is associated with more horsepower. The severity of an accident can be directly impacted by moving at a quicker speed.

How Much Does Best Insurance For Sports Cars Cost?

Given that sports vehicles can cost anywhere from tens of thousands of dollars to well over a million, it can be extremely expensive to insure one.

Even among cars in the same price range or with comparable performance specifications, you can expect greater variation in insurance premiums for sports cars than you can with sedans or minivans. For instance, the 0-60 timings for a 2016 Dodge Viper and a 2017 Acura NSX are comparable, yet the Viper is frequently more expensive to insure.

With an annual average cost of nearly $4,000 across the country, Nissan’s GT-R came in the first place as the most costly car to insure. In contrast, a Honda Odyssey minivan’s annual insurance premium is less than $1,300.

Also keep in mind that exotic and vintage sport car insurance is something entirely different because the automobile must be covered at a predetermined value, particularly if it is rare and needs to be appraised before being insured.

How to make insurance for sports cars to be less expensive?

Even though Best Insurance For Sports Cars can be more expensive than other types of auto insurance, there may be ways to cut your sports car insurance rates while still getting the coverage you need.

- Install a car alarm or other anti-theft technology

- Use a different vehicle to commute every day.

- You should drive your sports car fewer miles.

- Keep your driving record clear of moving offenses, license suspensions, and collisions where you were at fault.

- To receive additional auto savings, insure several vehicles.

- Combine your home and auto insurance to save money on numerous lines of coverage.

- Enroll in a driving safety course (Ask a local State Farm agent for a list of qualifying courses and requirements)

- Invest in a vehicle with a higher safety rating.

- Think about different coverage limits

Conclusion:

Get the Best Insurance For Sports Cars or insurance for high powered cars just like you would for any other vehicle. But keep in mind that fast cars can result in more expensive sport car insurance. For your insurance, greater horsepower entails more danger. Additionally, not all insurers cover all luxury cars. Let’s choose a well-known sports car insurance companies to get suitable packages for your vehicle.