Cars are currently a common mode of transportation for many individuals, which is why they are usually interested in purchasing high-quality auto insurance.

It is unavoidable that unpleasant events arise while driving a car, such as light scratches or scuffs, significant external damage, or other unfortunate accidents… Also, to set a limit If you want to reduce your financial losses if you find yourself in one of the aforementioned circumstances, you should acquire insurance from the most renowned and high-quality organizations. Let’s discover the most best car insurance companies with insurance.alltin.net.

What is the notion of car insurance?

Car insurance is a type of insurance that protects cars, property, goods, and people from future accidents or risks. When a car accident occurs, insurance firms will go above and above to compensate clients for both material and human harm.

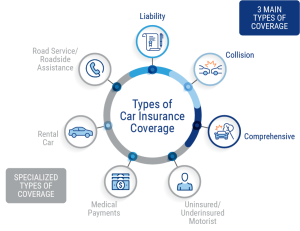

What types of car insurance are there?

Car insurance is currently separated into four categories:

- Compulsory insurance for vehicle owners’ civil responsibility;

- insurance for products on the vehicle’s civil liability;

- vehicle material insurance;

- insurance for vehicle occupants;

Why should you buy car insurance?

Because the number of vehicles on the road will increase, it will be increasingly difficult to avoid dangers or accidents when driving in traffic. A car crash or scratch is not ideal, and the expense of the repair is not inexpensive. As a result, having auto insurance will save you a lot of money in these instances.

In the current situation, we frequently refuse to purchase car insurance because we believe it would be pricey and unneeded. However, having car insurance will come in handy because accidents can occur at any time. As a result, in addition to purchasing mandatory civil insurance, we should look into alternative motor insurance options.

The best car insurance companies today

- PTI car insurance company

Because of its appealing perks and reasonable rates, PTI auto insurance is a product that many customers trust and prefer. It is ideal for a wide range of objects. Having your own car is no longer an uncommon thing to do in today’s world. A boxed car has no voice and no feelings, but it becomes a constant companion on the road.

PTI car insurance is a service of PTI, the Post and Telecommunications Insurance Joint Stock Company, which is also a well-known insurance provider. PTI will cover the costs of car repairs on behalf of users who are involved in accidents that fall under the company’s coverage.

The provider will, in particular, insure the car for physical damage in accordance with the legislation. Furthermore, the car’s value must not be less than 100 million VND at the time it enrolls in PTI insurance. The duration between when the car is built and when the insurance is acquired cannot be more than 15 years.

When you sign up with PTI vehicle insurance, you get the following benefits:

- 484 garages are licensed to repair and maintain automobiles;

- Within 100 kilometers, a free car rescue service is available;

- When changing automotive parts, there is no depreciation deduction;

- The company’s payment is guaranteed;

- Supervise the company’s vehicle damage assessment in accordance with its requirements;

- PJICO car insurance company

In June 1995, the PJICO Insurance Joint Stock Company (also known as PETROLIMEX Insurance Joint Stock Company) was founded. PJICO also garnered significant appreciation for its operation and development capacity, as it possesses 7 highly large shareholders in the economic sphere.

PJICO is also Vietnam’s first insurance firm to operate on a share basis, and it has a huge number of devoted consumers. The company’s operating criteria are to be among the top four leading car insurance companies in Vietnam.

Regulations on physical insurance for PJICO cars:

Subjects of application: Cars and special-purpose motorcycles, such as cars, tractors, trailers, or semi-trailers hauled by cars or tractors, construction motorcycles, agricultural and forestry motorcycles, and other special vehicles participating in road traffic are all included.

In the following instances, PJICO Insurance is responsible for compensating motor vehicle owners for physical damage caused by natural disasters, unexpected or unforeseeable accidents:

- Crashes, crashes (including collisions with non-motor vehicle items), overturns, sinks, the entire vehicle sinks, and is hit by other things.

- Fire, explosion.

- Natural disasters that occur as a result of force majeure.

- Theft or robbery results in the total loss of the car.

In addition to the amount of compensation, PJICO reimburses the motor vehicle owner for necessary and reasonable expenses incurred in performing the work required and instructed by PJICO when the loss happens, as specified in the insurance contract. (as part of the coverage), including costs:

- Prevention costs limit additional losses.

- The cost of rescue and transportation of the damaged vehicle to the nearest repair place, but not exceed 10% of the insured amount.

PJICO car physical insurance premiums range from 1.4 percent to 1.7 percent, with additional terms such as parts theft, no amortization when new replacements are made, repair facility selection, engine damage when entering flooded areas (Hydro-kicking), and insurance deductibles of 500,000 VND per case available.

- Baoviet car insurance company

Bao Viet vehicle insurance is one of the oldest insurance firms still in operation today. The organization is always upfront about its costs and insurance policies, provides excellent service, and rapidly resolves client issues.

Baoviet has a broad network of specific enterprises, with 67 subsidiaries, over 300 sites to serve consumers across the country, and over 3000 people. Customers who visit Baoviet will be advised and their inquiries will be answered, as well as what form of insurance they should purchase to meet their demands and budget.

The subject of car insurance:

The physical damage to a vehicle that occurs as a result of unanticipated incidents beyond the car owner’s control in particular situations as defined by insurance requirements.

Car insurance coverage:

- Unexpected accidents beyond the car owner’s control when traveling in the following situations: collision, overturning, toppling, falling; sunk; fire, fire, explosion; being struck by falling or falling debris.

- Storms, floods, landslides, lightning strikes, earthquakes, hailstorms, and tsunamis are examples of natural catastrophes.

- Stolen, robbed the whole car.

- Furthermore, Baoviet pays the required and reasonable expenses deriving from the insurance-covered accident in order to prevent and limit additional losses, protect, and transport the damaged vehicle to the nearest repair facility. First, determine the extent of the damage.

Car insurance benefits:

- The basic premise of compensation is to return the vehicle to its former condition before the loss.

- Parts loss compensation: Baoviet is liable for covering the actual expenses of repairing or replacing the damaged parts (if they can’t be fixed).

- Total loss compensation: The car is considered a total loss in the following situations: The vehicle has been damaged to the point that it can no longer be repaired or restored to ensure safe circulation or the cost of restoration is equivalent to or greater than the vehicle’s true value. Theft or robbery of a vehicle (with the conclusion of the competent authority). The overall compensation amount is equivalent to the vehicle’s true value prior to the accident (loss), and it does not exceed the insurance amount shown on the Certificate of Insurance.

- Oil and Gas Insurance Company PVI

PVI Oil and Gas Insurance is a unique firm in that it was founded and developed by PVN, Vietnam’s national oil and gas company. In the insurance business, the company also had certain accomplishments, such as having a dedicated customer base and obtaining the labor hero medal.

Insurance for automobiles PVI Petroleum is one of the most popular retail items. PVI Insurance said it will continue to promote the development of an effective retail system, develop competitive reinsurance programs, maintain traditional customers, and work toward developing information technology systems that meet international standards, as well as improving business processes and risk management through technology. Automobiles operating in Vietnam’s territory are covered, including the body, frame, shell, machinery, and other components, as well as additional vehicle equipment.

Insurance benefits:

Vehicle owners/Insured persons are compensated for material damage caused by natural disasters, and unexpected or unforeseen accidents… in the following cases:

- Crashes (including collisions with non-motor vehicle items), overturns, overturns, sinks, the entire vehicle collapses, and is hit by other things

- Fire, explosion

- Natural catastrophes that occur as a result of force majeure (Including but not limited to storms, floods, floods, lightning strikes, thunderstorms, earthquakes, landslides, tsunamis….)

- Loss of the entire car due to theft, robbery

- Malicious acts, intentional vandalism (excluding malicious acts, intentional vandalism of the Vehicle Owner/ Legal Representative of the Vehicle Owner/ Insured Person/ Driver/ Assignee to use the vehicle).

PVI insurance differs from other types of insurance in the following ways:

- In Vietnam, the most reputable, capable, and high-quality insurance company.

- Consultants who are professional, enthusiastic, and dedicated.

- The garage system complies with national regulations.

- Claims are settled fast, correctly, and satisfactorily.

- Ready to support and advise 24/7 by Customer Service Center (hotline 1900 54 54 58).

- Military Insurance – MIC

Military Insurance Corporation (Formerly Military Insurance Joint Stock Company) was founded under Central Military Commission Decision No. 871/BQP dated February 22, 2007, and License No. 43GP/KDBH dated February 22, 2007. The Ministry of Finance released a statement on October 8, 2007. Military Insurance Corporation is one of Vietnam’s leading non-life insurance companies, with a modest capital of 300 billion VND and an income of slightly over 100 billion VND in its first year.

MIC currently offers over 160 different insurance products, ranging from highly specialized and complex insurance products like aviation energy insurance, offshore wind energy insurance, and so on, to extremely close-knit products like MIC Care health insurance, MIC Miracle insurance, car insurance, Peace of mind insurance, and so on.

When an insured loss happens, MIC also covers essential and reasonable expenses as stipulated in the insurance contract, including:

- Prevent and limit losses

- Rescue and transportation costs to the nearest repair facility

- If the damage is covered by insurance, it will be assessed.

Level of liability insurance:

- The amount that the automobile owner requires the insurance provider to insure for his or her vehicle is mentioned on the Certificate of Insurance/Insurance Policy and must not exceed the vehicle’s market value.

- Vehicle owners might agree to insure their vehicles for a price that is equal to or less than their market worth.

Extended Terms:

- Insurance for accidents occurring outside the territory of Vietnam;

- Parts theft insurance;

- Insurance does not deduct new depreciation;

- Water damage insurance;

- Service interruption insurance;

- Genuine repair insurance;

- Insurance selection of repair facilities,…

Car insurance is included in the price of a new car, with civil insurance being required for vehicle registration and material insurance being optional. However, as a car owner, you will be unable to predict unexpected accidents that may result in injuries or property damage. The insurance will then assist you in partially or totally reducing the cost burden when you need to repair or compensate for damage to your vehicle (physical insurance/ auto body insurance). individuals (civil insurance). As a result, you have the freedom to select a reliable insurance provider with excellent service and appealing incentives. Hopefully, this post has helped you in selecting the greatest and most appropriate vehicle insurance company for your needs.