The market for electric vehicles (EVs) is beginning to pick up speed. In addition to being environmentally friendly alternatives to gasoline and diesel cars, they might also be less expensive to maintain over time. Prospective purchasers might be concerned about where they can acquire suitable Electric Car Insurance. Let’s follow us to find out about Insurance for Your Electric Car in this post!

Is Insurance for Your Electric Car required?

Electric automobiles, like those with internal combustion engines, need to be covered by insurance coverage in order to be driven on public highways. Although electric car insurance policies provide nearly identical guarantees to traditional policies, they also offer extra alternatives to give eco-drivers some peace of mind while on the road.

What are the different policies for Insurance for Your Electric Car?

Defendants’ insurance

Driving on public roads is prohibited without third-party liability insurance, which is automatically included in this. This is the bare minimum of insurance, and it only covers third-party losses when the policyholder is at fault. Other options, such as coverage against fire or theft, can be added to this sort of insurance. It is typically advised for used cars with a lot of miles.

Comprehensive protection

This provides thorough security because it protects against both third-party and insured-caused material loss. It covers repairs and part replacements in the event of damage, which can be costly for electric vehicles. Similarly to this, the majority of comprehensive insurance policies provide payment for any damaged batteries that were leased from the manufacturer.

Assuring each mile

Per-mile insurance is becoming more and more common among insurers. This could be third-party or comprehensive insurance, and the cost is determined by how many miles are covered. Therefore, drivers who rarely use their cars or who only make short trips find per-mile insurance to be particularly appealing.

Why Is Insurance for Electric Cars More Expensive?

When insurance companies establish their rates, they take into consideration past claims for vehicles that are comparable, among other factors. For instance, if your electric car model has a history of high-cost and/or frequent claims, insurance costs will typically be higher for all owners of the model.

Insuring an electric vehicle may be more expensive for the following reasons:

- Replacement components Electric parts are frequently more expensive to repair and replace than their non-electric counterparts. According to a survey from CCC Intelligent Solutions, a data provider to the automotive, collision repair, and insurance industries, replacement parts for an EV are 2.7% more costly than replacement parts for a gas-powered car.

- Batteries for electric vehicles. According to GreenCars, a website that offers information and services for electric car purchasers, the cost to repair a broken battery in an EV can range between $5,000 and $15,000.

- Repair services. Because repairing EVs requires specialized skills, facilities could charge more for repairs.

Why is EV car insurance necessary?

Your financial security is the primary purpose of car insurance coverage. It will be useful in the event of an accident, if your car is destroyed by a natural disaster or man-made calamity, or even if it is stolen. Additional justifications for buying electric car insurance include the following:

Legal prerequisite

The Motor Vehicles Act of 1988 mandates that any car you buy to be covered by insurance, more specifically third-party liability insurance. With third-party liability insurance, you are protected in the event that an accident involving your car causes harm to a third party’s person or property. This was made necessary with the reasoning that victims would be fairly reimbursed if everyone had third-party liability insurance.

Financial security

If you are the victim of an accident, you may be entitled to reimbursement or compensation from the at-fault party’s third-party liability plan for the harm done to your car. In addition, due to the current scarcity of their parts, repairs for electric vehicles are more expensive, making insurance a no-brainer.

Own injury

You might be at blame for starting a collision, in which case you’d need the personal damage coverage of a comprehensive auto insurance policy to cover the cost of repairing your own automobile. This is important since, over time, electric automobiles typically outperform their ICE equivalents in terms of value. Additionally, insurance safeguards your vehicle against theft and damage brought on by calamities caused by nature or by human activity, such as earthquakes, floods, fires, vandalism, riots, etc.

Which supplemental coverage is offered for electric vehicles?

There are other choices designed especially for electric cars, including coverage for any claims pertaining to the vehicle’s charging. If you run out of charge while in the UK, you can also choose to be recovered to the closest charging station. There may also be extra features like guarantees on repairs, emergency coverage, travel coverage, and breakdown coverage.

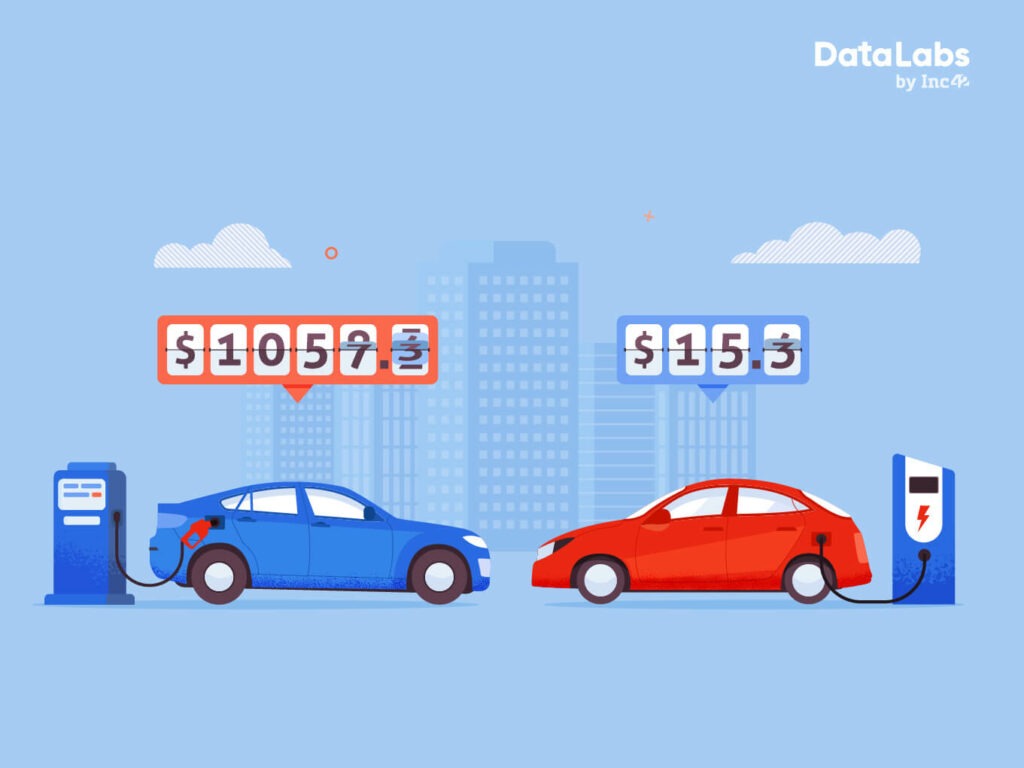

How much does an electric car’s insurance cost?

Insurance for an electric automobile is frequently more expensive than for a combustion engine vehicle, despite the additional assurances related to the battery and charging. Because they cost more to buy and have less information about them than their petrol and diesel counterparts, there is a price differential. Electric and hybrid vehicles are thought to be more prone to crash into pedestrians than regular cars.

This is a result of their almost silent operation at low speeds when only the battery is being used. Additionally, compared to gasoline or diesel vehicles, electric vehicles have a tendency to accelerate more quickly from a stop, which is thought to increase the likelihood of accidents.

It is anticipated that insurance premiums for electric cars will decrease in the future since collision avoidance technology is becoming less of a concern for insurers. Shop around since choosing the proper insurance is crucial if you want to take advantage of the special assurances offered by this ecologically beneficial means of transportation.

READ MORE