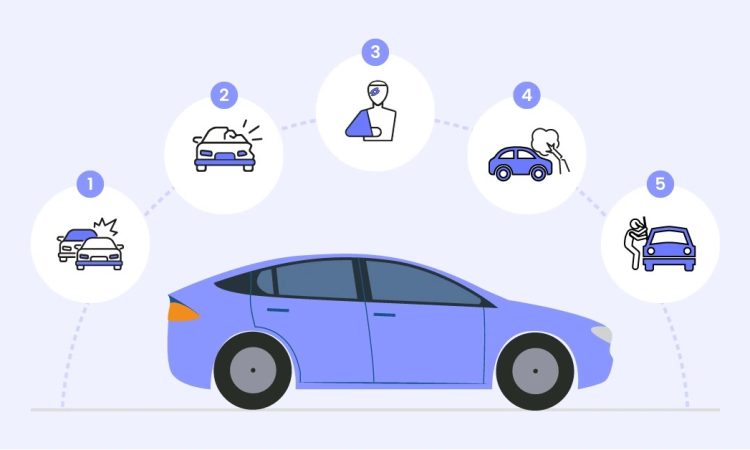

If you’re in the market for a new automobile or auto insurance, you should be aware of the many types of coverage offered on a policy.

There are several types of car insurance coverage available to assist protect you, your passengers, and your vehicle in the event of a car accident. Some of these coverages are required in your state, while others are optional. Understanding what is necessary for your state and what each helps cover can assist you in selecting the best coverage for your scenario. Let’s follow us to find out right now!

What is car insurance?

Car insurance is a required investment that protects you financially in the event of an accident. It is an excellent method of protecting yourself and others. Car insurance policies often include bodily injury liability, damage to property liability, uninsured or underinsured coverage, medical expenses, comprehensive physical damage coverage, and collision coverage. You can determine what type of coverage is required and how much coverage is required.

6 Types of Car Insurance You Should Consider

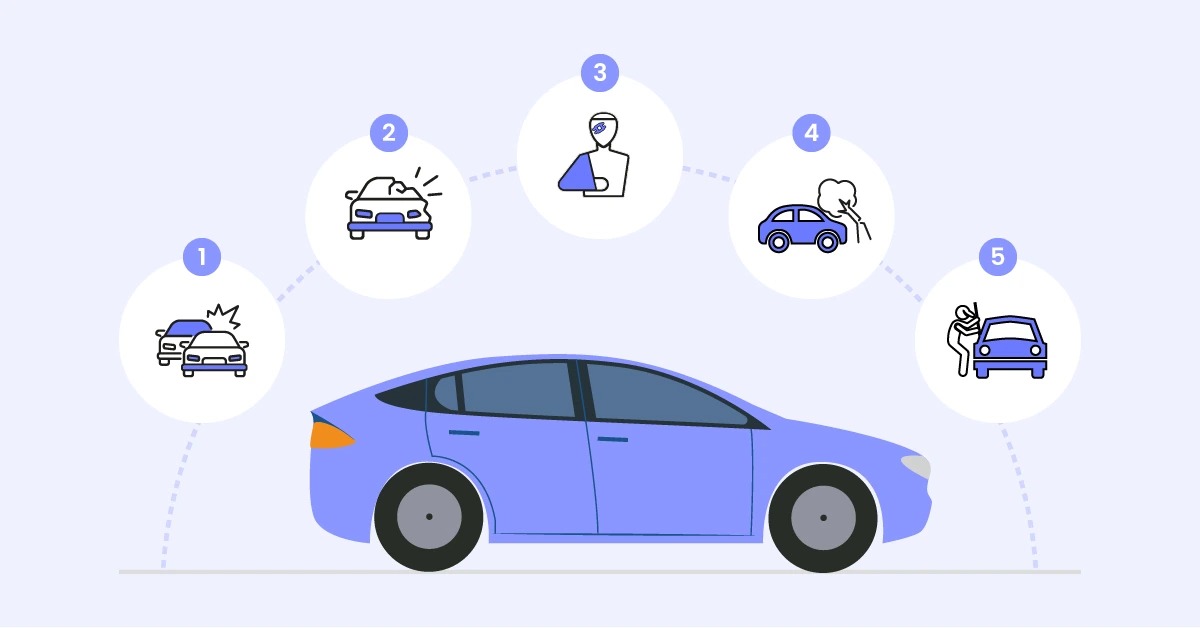

Insurance for Bodily Injury Liability (BI)

Bodily injury insurance coverage is intended to compensate for someone else’s medical expenditures if you damage them in an accident in which you are found to be at fault. This coverage may apply to you as well as any other drivers named on your policy.

Liability Insurance for Property Damage (PD)

Damage to property liability insurance will also cover you if you are at fault in an accident. It covers repairs to another driver’s vehicle as well as any other property you may damage.

Personal Injury Protection Coverage vs. Medical Payments Insurance (PIP)

When you or a passenger in your vehicle is injured in an accident, medical payments or medical negligence protection coverage can assist in covering the associated medical bills. This form of coverage can also cover lost income if you or an injured passenger are unable to work, as well as funeral costs if someone in your vehicle dies in an accident.

Coverage for Collisions

While damage to property liability insurance covers damage to another person’s vehicle or property as a result of an accident, collision coverage covers damage to your own car or property. Damages caused by an accident with another vehicle or hitting a stationary car, such as a tree or fence, can be included.

Complete Protection

Comprehensive coverage compensates you for car loss, theft, or damage caused by causes other than an accident. This can include fire damage, hail damage, and other falling objects, as well as animal harm.

Coverage for Uninsured/Underinsured Motorists

Underinsured motorist coverage might protect you if you are involved in an accident and the at-fault driver does not have enough insurance. Uninsured motorist coverage is intended to protect you if you are involved in an accident with a driver who does not have any insurance at all.

What Happens If You Don’t Have Automobile Insurance?

Driving a vehicle without car insurance (or completing financial responsibility requirements, in the case of New Hampshire) is against the law regardless of where you live. Financial responsibility regulations demand you provide proof that you can pay the damages yourself if you’re involved in an accident.

Several things can happen if you drive without insurance and get into an accident. First, depending on your state’s rules and the facts of the collision, you could be ticketed and/or prosecuted for a driving offense. At the very least, your driver’s license may be suspended or revoked.

You may also face a civil lawsuit if you are at fault in the accident and inflict bodily harm or property damage. Without an insurance policy to cover damages, you could be held financially liable for someone’s medical bills and/or vehicle repairs. That might be financially disastrous depending on the severity of their injuries or property damage.

Which Types of Car Insurance are the most affordable?

The cheapest sort of auto insurance will be determined by your individual circumstances. However, although providing the most coverage of the three policy kinds, fully comprehensive coverage is frequently the most affordable sort of car insurance.

It used to be the other way around until insurers noted an increase in claims on third-party-only plans as a result of younger or newer drivers picking this as the lowest choice. This increased the cost of third-party-only plans, therefore the trend reversed, and fully comprehensive coverage is now the lowest.

What does the term “mandatory excess” on insurance policy mean?

Excess is required with several types of car insurance. This is the amount you must pay in the event of an accident; it is what you pay out of your own pocket when you file a claim. The insurer determines the policy’s mandatory excess, which can take into account the risk of an accident. As a result, novice or young drivers, as well as those driving expensive vehicles such as high-performance cars, may incur hefty mandatory excess expenses.

Voluntary excess, like obligatory excess, exists on several types of vehicle insurance contracts. You can, however, set your own limit and select how much you want to pay in the event of an accident.

Typically, the bigger the optional excess, the lower the insurance policy premium. However, you will usually be limited in how much you can pay. It’s critical that you set a price that you can afford – and keep in mind that you’ll be paying this on top of the mandatory excess. As a result, ensure that the sum of each of these prices is within your budget.

READ MORE: